UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy StatementConsent Solicitation Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

FLEXSHOPPER, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: N/A |

| (2) | Aggregate number of securities to which transaction applies: N/A | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A | |

| (4) | Proposed maximum aggregate value of transaction: N/A | |

| (5) | Total fee paid: N/A |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: N/A |

| (2) | Form, Schedule or Registration Statement No.: N/A |

| (3) | Filing Party: N/A |

| (4) | Date Filed: N/A |

Preliminary copy - Subject to Completion

March24, 2017

2700 North Military Trail, Ste. 200

Boca Raton, FL 33431

AprilSeptember , 20172018

Notice of CONSENT SOLICITATION

Dear Stockholder:

You are cordially invited to attend the annual meetingThe Board of stockholdersDirectors of FlexShopper, Inc., a Delaware corporation (the “Company,” “we,” “us” or “our”), is providing you the accompanying consent solicitation statement on Schedule 14A (the “Consent Solicitation Statement”) in order to obtain from the Company’s stockholders written consents approving and authorizing a certificate of amendment (the “Certificate of Amendment”) to the Company’s certificate of incorporation to increase the number of authorized shares of common stock, par value $0.0001 per share, of the Company (“Common Stock”), from 15,000,000 to 25,000,000. Such approval and authorization by the stockholders is herein referred to as the “Action.” The number of authorized shares of the Company’s preferred stock, par value $0.001 per share (the “Preferred Stock”), will remain 500,000.

The Action is described in more detail in the accompanying Consent Solicitation Statement and the Certificate of Amendment is attached asAnnex A thereto.

We have established the close of business on September 7, 2018 as the record date for determining stockholders entitled to submit written consents. Stockholders constituting the holders of a majority of voting power of the Company’s (1) outstanding Common Stock entitled to vote thereon and (2) outstanding Common Stock and outstanding Preferred Stock entitled to vote thereon, voting together, in each case as of the close of business on the record date, must consent in order for the Action to be held at 11:approved by stockholders.

The Company’s Board of Directors recommends that all stockholders consent to the Action by marking the box entitled “FOR” and submitting to the Company the Action by Written Consent form, which is attached asAnnex B to the Consent Solicitation Statement.To be counted, your properly completed and executed Action by Written Consent form must be received by the Company on or before 5:00 a.m.p.m. Eastern Time on , local time, on Wednesday, May 10, 2017,2018 (the “Expiration Date”), subject to early termination or extension of the Expiration Date at the Company’s corporate headquarters located at 2700 North Military Trail, Suite 200, Boca Raton, Florida.discretion.

We look forwardThe Consent Solicitation Statement is being sent on or about September 17, 2018 to your attending either in person or by proxy. Further details regardingstockholders of record of the matters to be acted upon at this meeting appear inCompany’s capital stock as of September 7, 2018. The date of the accompanying Notice of 2017 Annual Meeting and Proxy Statement. Please give this material your careful attention.Consent Solicitation Statement is September , 2018.

| Very truly yours, | |

/s/ | |

| Brad Bernstein | |

FLEXSHOPPER, INC.2700 North Military Trail, Ste. 200Boca Raton, FL 33431NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERSTo Be Held on May 10, 2017

To the Stockholders of FlexShopper, Inc.:

NOTICE IS HEREBY GIVEN that the 2017 Annual Meeting of Stockholders of FlexShopper, Inc., a Delaware corporation, will be held on Wednesday, May 10, 2017 at 11:00 a.m., local time, at the Company’s corporate headquarters located at 2700 North Military Trail, Ste. 200, Boca Raton, Florida, for the following purposes:

Only stockholders of record at the close of business on March 23, 2017, the record date fixed by the Board of Directors, are entitled to notice of and to vote at the annual meeting and any adjournment or postponement thereof. If you plan to attend the annual meeting and you require directions, please call us at (561) 419-2923.

| |

| Brad Bernstein | |

| Chief Executive Officer, President and Chairman |

Boca Raton, FloridaApril , 2017

FLEXSHOPPER, INC.

2700 North Military Trail, Ste. 200

Boca Raton, FL 33431

CONSENT SOLICITATION STATEMENT

This Consent Solicitation Statement is being furnished in connection with the solicitation of written consents (the “Consent Solicitation”) of the stockholders of FlexShopper, Inc. (the “Company,” “we,” “our,” or “us”) approving and authorizing a certificate of amendment (the “Certificate of Amendment”) to the Company’s certificate of incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of common stock, par value $0.0001 per share, of the Company (“Common Stock”), from 15,000,000 to 25,000,000 (the “Increase in Authorized Shares”). Such approval and authorization by the stockholders is herein referred to as the “Action.” The number of authorized shares of the Company’s preferred stock, par value $0.0001 per share (the “Preferred Stock”), will remain 500,000 shares.

Our Board of Directors (the “Board”), approved and authorized the Certificate of Amendment on August 30, 2018 and recommends that stockholders consent to the Action.

The Company has decided to seek the written consent of stockholders through a consent solicitation process rather than holding a special meeting of stockholders in order to eliminate the costs and management time involved in holding a special meeting. The Increase in Authorized Shares is intended to enable us to engage in possible future financings and accomplish other corporate purposes as the Board determines in its discretion. These corporate purposes may include future financings, acquisitions, stock options and other equity benefits.

Voting materials, which include this Consent Solicitation Statement and an Action by Written Consent form (attached hereto asAnnex B), are being mailed to stockholders of record on or about September 17, 2018. Our Board set the close of business on September 7, 2018 as the record date for the determination of stockholders entitled to act with respect to the Consent Solicitation (the “Record Date”).

Final results of this Consent Solicitation are expected to be published in a Current Report on Form 8-K by the Company and posted on its website in satisfaction of the notice requirement under Section 228 of the Delaware General Corporation Law (“DGCL”).

Important notice regarding the availability of voting materials for the Action:

This Consent Solicitation Statement and the Action by Written Consent form are also available on the Internet at the following address: https://www.cstproxy.com/flexshopper/[_______]/.

1

PROXY STATEMENTTABLE OF CONTENTS

i

Preliminary copy - SubjectStockholders who wish to Completion

March24, 2017consent must deliver their properly completed and executed Action by Written Consent form to the Company by mail, facsimile or email so that it is received on or before 5:00 p.m. Eastern Time on , 2018 (the “Expiration Date”). The Company reserves the right (but is not obligated), in its sole discretion and subject to applicable law, at any time prior to the Expiration Date to (i) terminate the Consent Solicitation for any reason, including if the consent of stockholders holding a majority of the Company’s outstanding shares of capital stock has been received; or (ii) amend the terms of the Consent Solicitation (including to extend the Expiration Date). The Company reserves the right (but is not obligated) to accept any written consent received by any other reasonable means or in any form that reasonably evidences the giving of consent to the approval of the Action.

FLEXSHOPPER, INC.2700 North Military Trail, Ste. 200Boca Raton, FL 33431

PROXY STATEMENT

The Board of Directors (the “Board”) of FlexShopper, Inc. (the “Company,” “FlexShopper,” “we,” “us” or “our”) is providing these materials to you in connection with FlexShopper’s annual meeting of stockholders. The annual meeting will take place on Wednesday, May 10, 2017, 11:00 a.m., local time, at the Company’s corporate headquartersOur executive offices are located at 2700 North Military Trail, SuiteSte. 200, Boca Raton, Florida. This proxy statementFL 33431 and the accompanying notice and form of proxy are being made available to stockholders on or about April , 2017our telephone number is (855) 353-9289.

.VoteS Required; MANNER OF APPROVAL

Why am I receiving these materials?

You have received these proxy materials becauseStockholder approval of the Board is soliciting your proxyCertificate of Amendment will be effective upon our receipt of the written consent, not previously revoked, of the holders of a majority of voting power of (1) outstanding Common Stock entitled to vote your shares at the annual meeting. This proxy statement includes information that we are required to provide to you under Securitiesthereon and Exchange Commission (“SEC”) rules(2) outstanding Common Stock and is designed to assist you in voting your shares.

What is a proxy?

The Board is asking for your proxy. This means you authorize persons selected by usPreferred Stock entitled to vote your shares at the annual meeting in the way that you instruct. All shares represented by valid proxies received before the annual meeting will be voted in accordance with the stockholder’s specificthereon, voting instructions.

What is included in these materials?

These materials include:

What items will be voted on at the annual meeting?

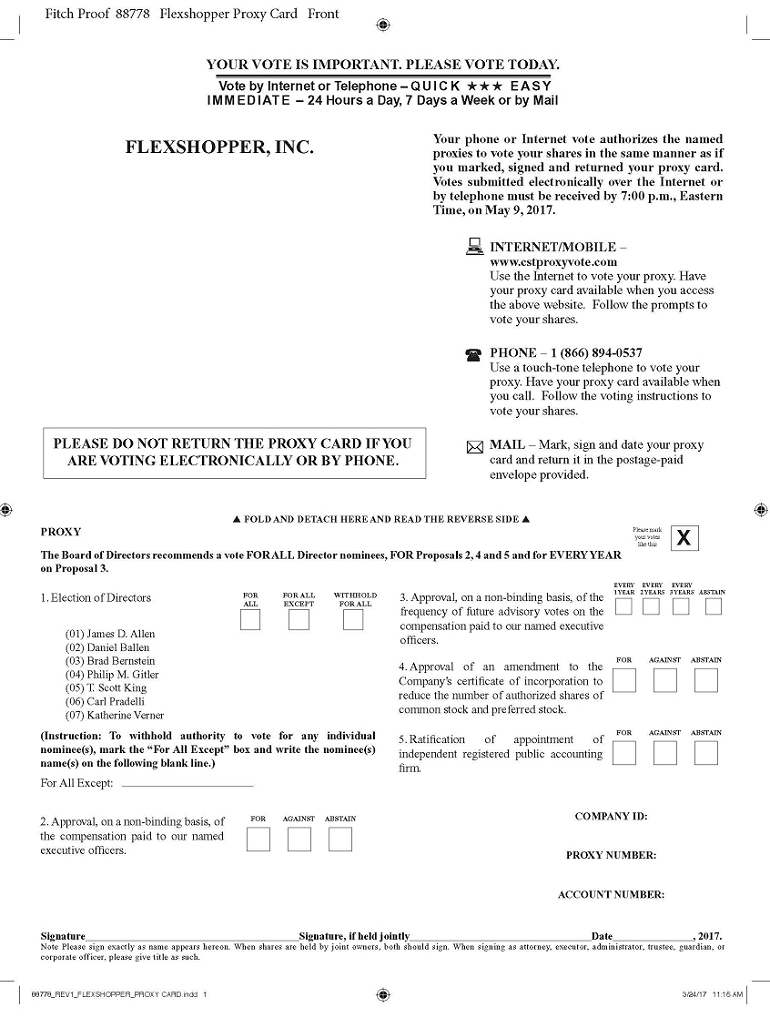

There are five proposals scheduled to be voted on at the annual meeting:

The Board is not aware of any other matters to be brought before the meeting. If other matters are properly raised at the meeting, the proxy holders may vote any shares represented by proxy in their discretion.

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

Who can attend the annual meeting?

Admission to the annual meeting is limited to:

Each stockholder may be asked to present valid picture identification, suchtogether as a driver’s license or passport, and proof of stock ownership as of the record date.

When is the record date and who is entitled to vote?

The Board set March 23, 2017 as the record date. All record holders of FlexShopper common stock and preferred stock as of the close of business on that date are entitled to vote.single class. Each share of common stockCommon Stock is entitled to one vote. The outstanding Preferred Stock of the Company consists of both Series 1 Preferred Stock and Series 2 Preferred Stock. Each share of Series 1 Preferred Stock is entitled to 0.578775.7877 votes, voting together as a single class with holders of common stockCommon Stock and Series 2 Preferred Stock. Each share of Series 2 Preferred Stock is entitled to 123.4568 votes, voting together as a single class with holders of common stockCommon Stock and Series 1 Preferred Sock.Stock. As of the record date,Record Date, there werewill be outstanding 5,287,391approximately 5,469,501 shares of common stockCommon Stock entitled to 5,287,3915,469,501 votes, at the annual meeting, 243,065239,405 shares of Series 1 Preferred Stock entitled to 140,6791,385,605 votes, at the annual meeting, and 21,952 shares of Series 2 Preferred Stock entitled to 2,710,124 votes at the annual meeting.votes.

What isThe failure to submit a stockholder of record?

A stockholder of recordwritten consent or, registered stockholder is a stockholder whose ownership of FlexShopper stock is reflected directly on the books and records of our transfer agent, Continental Stock Transfer & Trust Company. If you hold stock through an account with a bank, broker or similar organization, youif your shares are considered the beneficial owner of shares held in “street name” and are not a stockholder of record. For shares held in street name, the stockholder of record is” to give appropriate instructions to your bank, broker or similar organization. We onlynominee, will have access to stock ownership information for registered stockholders. If you are not a stockholder of record, we will require additional documentation to evidence your stock ownershipthe same effect as ofvoting against the record date, suchAction. Abstentions also have the same effect as a copy of your brokerage account statement, a letter from your broker, bank or other nominee or a copy of your notice or voting instruction card. As described below, if you are not a stockholder of record, you will not be able to vote your shares unless you have a proxy fromagainst the stockholder of record authorizing you to vote your shares.

How do I vote?

You may vote by any of the following methods:

How can I change or revoke my vote?Action.

If you are a stockholder of record, you may change or revoke your proxy any time before it is voted at the annual meeting by:

If you hold your shares beneficiallyare held in a brokerage account in your broker’s name (“street name,name”), you have the right to direct your broker or nominee to consent or withhold consent with regard to the Action. You should follow the instructions provided by your broker or nominee. You may changecomplete and mail an instruction card to your vote by submitting newbroker or nominee or, if your broker allows, submit voting instructions to your bank,broker by telephone or the internet. If you provide specific voting instructions by mail, telephone or the internet, your broker or nominee following the instructions they provide.

What happens if I do not give specific voting instructions?

Stockholders of record. If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares as you have directed. If you do not provide voting instructions to your broker or nominee, your broker or nominee may not use its discretion to consent or withhold consent with regard to the Action.

The Company’s Board of Directors recommends that all stockholders consent to the Action by marking the box entitled “FOR” and submitting to the Company an executed Action by Written Consent form, which is attached asAnnex B to this Consent Solicitation Statement, by mail, facsimile or email so that it is received on or before 5:00 p.m. Eastern Time on the Expiration Date. If you sign and send in an Action by Written Consent form but do not indicate how you want to vote as to the manner recommended byAction, your consent form will be treated as a consent “FOR” the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion for any other matters properly presented for a vote at the meeting.Action.

REVOCATION OF CONSENTS

Beneficial ownersWritten consents may be revoked or withdrawn by any stockholder at any time before the Expiration Date or earlier termination of the Consent Solicitation or effective date of the Action, as applicable. A notice of revocation or withdrawal must specify the record stockholder’s name and the number of shares heldbeing withdrawn. After the Expiration Date, all written consents previously executed and delivered and not revoked will become irrevocable. Revocations may be submitted to the Corporate Secretary of the Company by the same methods as written consents may be submitted, as set forth in “street name.” If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is referred toAction by Written Consent form attached hereto as a “broker non-vote.”Annex B.

Which ballot measures are considered “routine” or “non-routine”?PROPOSED ACTION:

The election of directors (“Proposal 1”), the approval, on a non-binding advisory basis,APPROVAL OF CERTIFICATE OF AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT AN INCREASE IN OUR AUTHORIZED SHARES OF COMMON STOCK

Upon recommendation of the compensation paid to our named executive officers (“Proposal 2”) and the approval, on a non-binding advisory basis,Board, stockholders of the frequencyCompany are being asked to execute written consents approving and authorizing the Certificate of future advisory votes on the compensation paidAmendment to our named executive officers (“Proposal 3”) are considered to be non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals 1, 2 and 3.

The approval of an amendment to the Company’s certificate of incorporation to reduceincrease the number of authorized shares of common stock and preferred stock (“Proposal 4”Common Stock from 15,000,000 to 25,000,000 (the “Increase in Authorized Shares”) and the ratification. The number of authorized shares of the appointmentCompany’s Preferred Stock will remain 500,000 shares. The Certificate of EisnerAmper as our independent registered public accounting firm for 2017 (“Proposal 5”) are considered to be routine matters under applicable rules. A broker or other nominee may generally voteAmendment was authorized and approved by the Board on routine matters, and we do not expect there to be any broker non-votes with respect to Proposals 4 and 5.August 30, 2018.

What isThe Company intends to effect the quorum forIncrease in Authorized Shares by filing with the annual meeting?Delaware Secretary of State the Certificate of Amendment, a copy of which has been attached hereto asAnnex A, promptly following the effective date of the Action (as described below under the heading “Effective Date of the Action; Required Consent”).

Purpose and Effects of the Certificate of Amendment

Under our Certificate of Incorporation in effect as of the date of this Consent Solicitation Statement, we currently have authorized capital stock of 15,500,000 shares, of which 15,000,000 are designated as Common Stock and 500,000 are designated as Preferred Stock. As of the Record Date, the Company had a total of 5,469,501 shares of Common Stock outstanding, excluding: 239,405 outstanding shares of Series 1 Preferred Stock convertible into 145,197 shares of Common Stock; 21,952 outstanding shares of Series 2 Preferred Stock convertible into 2,710,124 shares of Common Stock; 439 shares of Series 2 Preferred Stock issuable upon the exercise of outstanding warrants convertible into 54,217 shares of Common Stock; 377,303 shares of Common Stock issuable upon the exercise of outstanding warrants; 426,400 shares of Common Stock issuable upon the exercise of outstanding stock options; and shares of Common Stock issuable upon conversion of outstanding subordinated promissory notes.

The presence,increase in personthe authorized number of shares of Common Stock as a result of the Certificate of Amendment will enable us to engage in possible future financings and accomplish other corporate purposes as the Board determines in its discretion. These corporate purposes may include future financings, potentially including the offering described in the Registration Statement on Form S-1 (Registration No. 333-226823) initially filed by us with the U.S. Securities and Exchange Commission (the “SEC”) on August 13, 2018, as amended, acquisitions and issuances of stock options and other equity benefits.

Anti-Takeover Effects of an Increase in Authorized Shares

Release No. 34-15230 of the Staff of the SEC requires disclosure and discussion of the effects of any action, including the proposal discussed herein, that may be used as an anti-takeover mechanism. The Certificate of Amendment will result in an increase in the number of authorized but unissued and unreserved shares of our Common Stock and could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or intent of our Board. An increase in the number of authorized shares of Common Stock could have other effects on our stockholders, depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. An increase in our outstanding shares could potentially deter takeovers, in that additional shares could be issued (within the limits imposed by proxy,applicable law) in one or more transactions that could make a change of control or takeover more difficult. For example, we could issue additional shares so as to dilute the stock ownership or voting rights of persons seeking to obtain control without our agreement. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The Increase in Authorized Shares therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the Increase in Authorized Shares may limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal.

Effective Date of the Action; Required Consent

Pursuant to DGCL Section 228, the Action will become effective on such date as the Company has received, in accordance with such section, written consents, not previously revoked, signed by holders of a majority of the voting power of (1) outstanding voting stockCommon Stock entitled to vote is necessary forthereon and (2) outstanding Common Stock and Preferred Stock entitled to vote thereon, voting together as a single class, each as of the transactionclose of business aton the annual meeting. This is calledRecord Date, so long as such written consents are delivered within 60 days of the Record Date. The Company intends to effect the Increase in Authorized Shares by filing with the Delaware Secretary of State the Certificate of Amendment, a quorum.copy of which has been attached hereto asAnnex A, promptly following the effective date of the Action. The Certificate of Amendment will not affect the relative voting power or equity interest of any stockholder. However, additional shares of Common Stock would continue to be available for issuance from time to time in the future. The shares issued pursuant to the Increase in Authorized Shares would dilute the percentage ownership interest of existing holders of our Common Stock and Preferred Stock and the value of the shares held by such stockholders may be diluted if shares are issued below what current stockholders paid for their shares.

What is the voting requirement to approve each of the proposals?Board Recommendation

The following are the voting requirements for each proposal:

How are abstentions and broker non-votes treated?

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present at the annual meeting. However, broker non-votes are not counted as votes present for any non-routine proposal considered at the annual meeting and, therefore, will have no effect on the proposals regarding the election of directors, the approval, on a non-binding advisory basis, of the compensation paid to our named executive officers and the approval, on a non-binding advisory basis, of the frequency of future advisory votes on the compensation paid to our named executive officers. We expect no broker non-votes on the routine proposals to approve of an amendmentBoard recommends that stockholders consent to the Company’s certificateCertificate of incorporationAmendment to reduceincrease in the number of authorized shares of common stockCommon Stock by marking the box entitled “FOR” and preferred stock andsubmitting to appoint EisnerAmperthe Company the Action by Written Consent form, which is attached as our independent registered public accounting firm for 2017. Abstentions will be counted as votes present and entitledAnnex B to vote on the proposals considered at the annual meeting and, therefore, will be counted as votes against the proposals.this Consent Solicitation Statement.

4

NO DISSENTERS’ RIGHTS

Who pays for solicitation of proxies?

WeNo dissenters’ or appraisal rights are payingavailable to the cost of soliciting proxies. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for sending proxy materials toCompany's stockholders and obtaining their votes. In addition to soliciting the proxies by mail, certain of our directors, officers and regular employees, without compensation, may solicit proxies personally or by telephone, facsimile and email.

Where can I find the voting resultsas of the annual meeting?

We will announce voting resultsRecord Date under the DGCL, the Certificate of Incorporation or the amended and restated bylaws of the Company in a Current Report on Form 8-K filedconnection with the SEC within four business days following the meeting.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2018 annual meeting of stockholders?Action.

Requirements for Stockholder Proposals to Be Considered for Inclusion in the Company’s Proxy Materials. Stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 2018 annual meeting of stockholders must be received by December 11, 2017. In addition, all proposals will need to comply with Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals must be delivered to the Company’s Secretary at 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431.INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

Requirements for Stockholder Proposals to Be Brought Before the 2018 Annual MeetingExcept as disclosed elsewhere in this Consent Solicitation Statement, no officer or director or any associate of Stockholders. Notice ofsuch person has any director nomination or other proposal that you intend to present at the 2018 annual meeting of stockholders, but do not intend to have includedsubstantial interest in the proxy statement and form of proxy relating to the 2018 annual meeting of stockholders, must be delivered to the Company’s Secretary at 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431 not earlier than the close of business on January 24, 2018 and not later than the close of business on February 23, 2018. In addition, your notice must set forth the information requiredmatters acted upon by our bylaws with respect to each director nominationBoard and stockholders, other than his or other proposal that you intend to present at the 2018 annual meeting of stockholders.her role as a stockholder, officer or director.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our voting stock as of March 23, 2017September 7, 2018 by:

● each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of any class of our voting stock;

● each “named executive officer” of the Company, as that term is defined in the Company’s definitive proxy statement on Schedule 14A filed with the SEC on March 13, 2018 and amended on April 19, 2018;

● each of our directors; and

● all executive officers and directors as a group.

Unless otherwise noted below, the address of each person listed on the table is c/o FlexShopper, Inc. at 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431. To our knowledge, each person listed below has sole voting and investment power over the shares shown as beneficially owned except to the extent jointly owned with spouses or otherwise noted below.

Beneficial ownership is determined in accordance with the rules of the SEC. The information does not necessarily indicate ownership for any other purpose. Under these rules, shares of stock which a person has the right to acquire (i.e.(i.e., by the exercise of any option or the conversion of preferred stock)such person’s Series 1 or Series 2 Preferred Stock) within 60 days after March 23, 2017September 7, 2018 are deemed to be beneficially owned and outstanding for purposes of calculating the number of shares and the percentage beneficially owned by that person. However, these shares are not deemed to be beneficially owned and outstanding for purposes of computing the percentage beneficially owned by any other person. The applicable percentage of common stock, Series 1 Preferred Stock and Series 2 Preferred Stock outstandingshares owned as of March 23, 2017September 7, 2018 is based upon 5,287,391, 243,065 and 21,9525,469,501 shares of Common Stock outstanding respectively, on that date.

| Name and Address of Beneficial Owner | Shares of Common Stock | Number of Shares Underlying Convertible Preferred Stock, Options and Warrants | Total Shares Beneficially Owned | Percentage of Common Stock Outstanding | Shares of Common Stock | Number of Shares Underlying Convertible Preferred Stock, Options and Warrants | Total Shares Beneficially Owned | Percentage of Shares Beneficially Owned | ||||||||||||||||||||||||

| Stockholders | ||||||||||||||||||||||||||||||||

| B2 FIE V, LLC (1) | - | 2,469,136 | (2) | 2,469,136 | 31.8 | % | ||||||||||||||||||||||||||

| Waterfall Asset Management, LLC (3) | 1,454,546 | - | 1,454,546 | 27.5 | % | |||||||||||||||||||||||||||

| B2 FIE V, LLC(1) | — | 2,469,136 | (2) | 2,469,136 | 31.1 | % | ||||||||||||||||||||||||||

| Waterfall Asset Management, LLC(3) | 1,629,547 | — | 1,629,547 | 29.8 | % | |||||||||||||||||||||||||||

| Morry F. Rubin | 541,326 | (4) | 66,667 | (5) | 607,993 | 11.5 | % | 541,326 | (5) | 66,667 | (6) | 607,993 | 11.0 | % | ||||||||||||||||||

| George Rubin | 285,526 | (6) | 66,667 | (7) | 352,193 | 6.7 | % | |||||||||||||||||||||||||

| PITA Holdings LLC(7) | 415,674 | — | 415,674 | 7.6 | % | |||||||||||||||||||||||||||

| George Rubin(8) | 285,526 | (9) | 66,667 | (10) | 352,193 | 6.6 | % | |||||||||||||||||||||||||

| Directors and Executive Officers | ||||||||||||||||||||||||||||||||

| James Allen | - | 12,000 | (8) | 12,000 | * | — | 24,000 | (11) | 24,000 | * | ||||||||||||||||||||||

| Daniel Ballen | - | - | - | * | — | — | — | * | ||||||||||||||||||||||||

| Brad Bernstein | 200,000 | (9) | 79,167 | (10) | 279,167 | 5.2 | % | 200,000 | (12) | 90,000 | (13) | 290,000 | 5.2 | % | ||||||||||||||||||

| Philip M. Gitler | - | - | - | * | ||||||||||||||||||||||||||||

| H. Russell Heiser | 10,400 | 13,334 | (11) | 23,734 | * | 46,622 | 25,000 | (14) | 71,622 | 1.3 | % | |||||||||||||||||||||

| T. Scott King | - | 18,000 | (12) | 18,000 | * | — | 24,000 | (15) | 24,000 | * | ||||||||||||||||||||||

| Marc Malaga | 172,984 | 136,338 | (13) | 309,322 | 5.7 | % | ||||||||||||||||||||||||||

| Marc Malaga(16) | 191,494 | 158,005 | (17) | 349,499 | 6.2 | % | ||||||||||||||||||||||||||

| Carl Pradelli | 18,750 | (14) | 18,000 | (15) | 36,750 | * | 18,750 | (18) | 24,000 | (19) | 42,750 | * | ||||||||||||||||||||

| Ravi Radhakrishnan | 65,400 | 10,000 | (20) | 75,400 | 1.4 | % | ||||||||||||||||||||||||||

| Katherine Verner | - | - | - | * | — | — | — | * | ||||||||||||||||||||||||

| All directors and executive officers as a group (9 persons) | 402,134 | 276,839 | 678,989 | 12.2 | % | 522,266 | 355,005 | 877,271 | 15.1 | % | ||||||||||||||||||||||

* Less than one percent.

(1) Based solely on the Schedule 13D filed on June 21, 2016 by PIMCO. According to the filing, B2 FIE V LLC (“B2 FIE”) was formed solely for the purpose of investing in FlexShopper. PIMCO BRAVO Fund II, L.P. (“Bravo II”) is the sole member of B2 FIE and operates as a pooled investment fund and invests (among other things) in operating companies. PIMCO GP XII, LLC (“PIMCO GP”) is the sole general partner of Bravo II. PIMCO is the sole managing member of PIMCO GP and has the power to make voting and investment decisions regarding the Preferred Stock held by B2 FIE. Each of Bravo II, PIMCO GP and PIMCO disclaims beneficial ownership of the Series 2 Preferred Stock except to the extent of its pecuniary interest therein. The address for this investor is 650 Newport Center Drive, Newport Beach, CA 92660.

(2) Consists of shares of Common Stock issuable upon the conversion of 20,000 shares of Series 2 Preferred Stock. Each share of Series 2 Preferred Stock is convertible into 123.4568 shares of Common Stock, based on the Series 2 Preferred Stock per share price of $1,000 and a conversion rate of $8.10 per share.

PROPOSAL 1—ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of seven members. Upon the recommendation of the Corporate Governance and Nominating Committee of our Board of Directors, the Board has nominated the seven current directors for election at the annual meeting to hold office until the next annual meeting of stockholders and the election of their successors.

Shares represented by all proxies received by the Board and not marked so as to withhold authority to vote for any individual nominee will be votedFORthe election of the nominees named below. The Board knows of no reason why any nominee would be unable or unwilling to serve, but if such should be the case, proxies may be voted for the election of some other person nominated by the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDSA VOTE FOR THE NOMINEES LISTED BELOW

The following table sets forth the nominees to be elected at the 2017 Annual Meeting, the year such director was first elected as a director, and the positions currently held by each director with FlexShopper.

| ||||

INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR

Set forth below is background information for each current director and nominee for director, as well as information regarding additional experience, qualifications, attributes or skills that led the Board of Directors to conclude that such director or nominee should serve on the Board.

James D. Allen, age 57, has been a director since February 2016. Mr. Allen currently serves as Chief Financial Officer of Hollander Sleep Products, LLC, the largest supplier of utility bedding products in North America. From July 2003 through November 2014, Mr. Allen served as VP Operations and Group CFO of Sun Capital Partners, a leading global private equity firm with an excess of $10 billion under management. From August 2008 through September 2014, Mr. Allen was a Partner and Group CFO of London-based Sun European Partners, the European affiliate of Sun Capital Partners. From July 2002 to July 2003, Mr. Allen was CAO of Mattress Firm, Inc., a leading bedding specialty retailer. Prior to joining Mattress Firm, Inc., Mr. Allen served for eight years in various capacities (President and COO, CFO and President of two operating divisions) at Tandycrafts, Inc. (NYSE: TAC), which operated a diversified portfolio of retail and consumer products businesses. Prior to Tandycrafts, Inc., Mr. Allen was a Senior Manager at the accounting firm of Price Waterhouse (now PwC). Mr. Allen received a B.B.A. degree, majoring in management and accounting, from Evangel University in Springfield, MO. Mr. Allen brings to the Board proven leadership and management experience and a deep knowledge of audit and accounting matters that make him well qualified to serve on the Board.

Daniel Ballen, age 34, has been a director since November 2016. Mr. Ballen is a Senior Vice President and Portfolio Manager for the alternative investment complex of Pacific Investment Management Company LLC (“PIMCO”), where he focuses on corporate private equity and special situations investing in both North America and Europe. Prior to joining PIMCO in 2014, Mr. Ballen was a member of the private equity investment teams at Pine Brook Partners and Bain Capital, where he executed and managed a number of private equity investments, with a particular focus on companies in the financial services sector. Mr. Ballen started his career in the investment banking division of Bear, Stearns & Co., where he was a member of the U.S. financial institutions advisory team. Mr. Ballen received a Bachelors degree, Summa Cum Laude, from Emory University. Mr. Ballen’s experience in finance makes him a valuable addition to the Board.

Mr. Ballen was appointed to the Board in connection with that certain Investor Rights Agreement dated June 10, 2016 (the “B2 FIE Investor Rights Agreement”) entered into by the Company, Brad Bernstein and B2 FIE in connection with B2 FIE’s purchase of Series 2 Preferred Stock. Pursuant to the B2 FIE Investor Rights Agreement, so long as B2 FIE and its affiliate transferees’ ownership percentage of the Company’s outstanding Common Stock, determined on a fully-diluted basis taking into account the conversion of all outstanding shares of Series 1 Preferred Stock and Series 2 Preferred Stock, exceeds 22%, B2 FIE shall have the right to nominate two directors to the Board.

Brad Bernstein, age 51, is a co-founder of FlexShopper and its Chief Executive Officer, President, and Chairman of the Board. Mr. Bernstein served as President and Chief Financial Officer of the Company from January 2007 through December 2014, during which time the Company was named Anchor Funding Services, Inc. and primarily engaged in the business of providing accounts receivable financing to businesses in the United States. Mr. Bernstein became CEO of FlexShopper in December 2014. Previously, Mr. Bernstein was employed by Preferred Labor LLC from March 1999 through January 2007. Mr. Bernstein served Preferred Labor LLC as its Chief Financial Officer and later as its President. Before joining Preferred Labor LLC, Mr. Bernstein was a partner of Miller, Ellin Consulting Group, LLP, where he advised commercial and investment banks, asset-based lenders, and alternative finance companies in connection with debt or equity investments. Mr. Bernstein has used his banking relationships to raise debt and negotiate and structure financing for companies. Mr. Bernstein brings to the Board his financial and business expertise as a Certified Public Accountant. Mr. Bernstein received a Bachelor of Arts degree from Columbia University. Mr. Bernstein’s executive experience with FlexShopper positions him well to serve as the Chairman of the Board.

Philip Gitler, age 43, has served as a director of the Company since April 2015. Mr. Gitler is a managing director at Waterfall Asset Management, LLC (“Waterfall”), anas the investment adviser focused on structured credit and whole loans. Prior to joining Waterfall in 2013, Mr. Gitler was managing member of PMG Advisors LLC, which he founded in 2012. PMG Advisors LLC consulted with finance companies and investors in the structured credit market. Previously, Mr. Gitler was a Vice President at Goldman Sachs & Co. (NYSE: GS), where he focused on asset and principal financings and advisory services with his clients, which included specialty finance, auto and equipment finance and leasing companies of various sizes. Prior to joining Goldman Sachs & Co., Mr. Gitler worked at Merrill Lynch & Co., where he held several positions in its investment banking and capital markets groups focused on asset and lease financing and securitization. Mr. Gitler received a Bachelor of Science degree in finance from the Pennsylvania State University and an M.B.A. from The Wharton School, University of Pennsylvania. Mr. Gitler’s extensive executive, managerial and leadership experience and his business acumen and experience make him a valuable addition to the Board.

Mr. Gitler was appointed to the Board in connection with that certain Investor Rights Agreement dated March 6, 2015 entered into by the Company, certain stockholders and several affiliates of Waterfall (the “Waterfall Funds”) in connection with the Waterfall Funds’ purchase of the Company’s Common Stock. Pursuant to the Investor Rights Agreement, so long as the Waterfall Funds, and their affiliate transferees beneficially own at least 10%Messrs. Thomas Capasse and Jack Ross, as members of issued and outstandingWaterfall, may be deemed to share beneficial ownership of the 1,454,546 shares of Common Stock owned by the Waterfall shall have the right to nominate one director to the Board.

T. Scott King, age 64, has been a director since November 2014. From April 2014 through September 2014, Mr. King served as Interim Chief Executive Officer of Gordmans Stores, Inc. (NASD: GMAN), an Omaha, NE-based apparel and home décor retailer withFunds, or approximately 100 stores. Mr. King has also served as Chairman27.5% of the Boardoutstanding shares of Gordmans Stores, Inc. From 2003 through 2014, Mr. King served as Senior Managing Director of Operations of Sun Capital Partners, a Boca Raton-based private equity firm with in excess of $10 billion assets under management. From 1999 through 2003, he served as President and Chief Executive Officer of Waterlink Inc., an Ohio-based, international provider of water and waste water solutions. Prior to his tenure at Waterlink Inc., Mr. King was employed for approximately 20 years with Sherwin-Williams Company, an international manufacturer and retailer of paint and coatings. Mr. King has served on the Board of Directors of The Limited, ShopKo, Furniture Brands Inc. and Boston Market. He also serves on the Board of Advisors of State University of NY at Oswego, School of Business, where he received his Bachelor of Arts in Business. Mr. King brings to the Board his financial and business experience as well as serving as a director on various boards of directors of public entities, making him an ideal candidate to serve as an independent director and as a financial expert on the Board.

Carl Pradelli, age 50, has been a director since July 2014. Since 2002, Mr. Pradelli has served as President, CEO, co-founder and a director of Nature City LLC, a developer and direct-to-consumer marketer of premium dietary supplements. Nature City LLC principally markets via direct mail and e-commerce channels. From 2002 through 2011, Mr. Pradelli also served as President, CEO and co-founder of Advanced Body Care Solutions, a marketer of health and beauty products using direct response television. Previously, he served as Senior Vice PresidentCommon Stock. Because of the investment banking firm Donaldson, Lufkin & Jenrette, which was acquired in 2000 by Credit Suisse First Boston. From 1999relationships described above, Mr. Capasse, Mr. Ross, WEMF, WDGP, WDOMF, WSGP and WSF (collectively, the “Reporting Persons”) may be deemed to 2004, Mr. Pradelli served asconstitute a director of Duane Reade, Inc. and on its compensation and governance committees. Mr. Pradelli received an MBA from Wharton Business School at the University of Pennsylvania and a Bachelors of Science in Finance and Accounting from Stern School of Business at New York University. Mr. Pradelli brings to the Board his financial and business experience as well as his experience serving as a public company director, making him an ideal candidate to serve as an independent director and as a financial expert on the Board.

Katherine Verner, age 48, has been a director since November 2016. Ms. Verner is a Senior Vice President and Portfolio Manager at PIMCO focused on the oversight of private equity investments within the firm’s alternative investment complex. Ms. Verner has over 25 years of experience in finance and real estate investing for private equity funds, including Oaktree Capital, ORIX and Goldman Sachs/Whitehall. Prior to joining PIMCO, she was a Managing Director of a start-up NPL platform in Europe for Oaktree Capital and Chief Operating Officer of two corporate finance companies, Goldman Sachs Specialty Lending Group and ORIX Finance, and Director of Executive Operations for Goldman Sach’s international asset management platform. Ms. Verner received a Bachelor of Science degree from Texas A&M University and a Masters in Real Estate from the University of Denver. Ms. Verner’s executive and finance experience make her a valuable addition to the Board.

Ms. Verner was appointed to the Board pursuant to the B2 FIE Investor Rights Agreement.

INFORMATION CONCERNING EXECUTIVE OFFICERS

Set forth below is background information relating to our executive officers:

Brad Bernsteinis discussed above underInformation Concerning Directors and Nominees for Director.

Russ Heiser has served as our Chief Financial Officer since December 2015. From July 2015 to December 2015, Mr. Heiser served as a consultant to the Company. From 2008 to 2015, Mr. Heiser served as an advisor to family offices in South Florida. In this role, Mr. Heiser focused on venture capital and private equity investments and was responsible for sourcing, financial analysis, transaction execution and management of portfolio companies across a variety of sectors. From 2004 to 2008, Mr. Heiser was an Executive Director in the Investment Banking Division at UBS in New York and, from 2001 to 2004, was an Associate in the Investment Banking Division at Bear, Stearns & Co. in New York. Mr. Heiser received his BS in Accounting from the University of Richmond and an MBA from Columbia Business School. Over the course of his career, Mr. Heiser has earned both CPA and CFA designations.

Marc Malaga has served as our Executive Vice President of Operations since December 2013. From 2010 through 2012, Mr. Malaga developed a private real estate portfolio, leading the strategic acquisition and management of foreclosed properties throughout south Florida. From 2000 to 2007, Mr. Malaga founded and served as Chief Executive Officer of GiftBaskets.com, which became a leading destination for online gift baskets and flower purchases.

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Board Independence

The Board of Directors has determined that each of Mr. Allen, Mr. Ballen, Mr. King, Mr. Pradelli and Ms. Verner is an independent director“group” within the meaning of Rule 13d-5 under the director independence standardsExchange Act and, as such, each member of The NASDAQ Stock Market (“NASDAQ”). Furthermore, the Board has determined thatgroup could be deemed to beneficially own, in the aggregate, all of the shares of Common Stock held by members of the Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee are independentgroup. The Reporting Persons do not admit that they constitute a group within the meaning of the director independence standards of NASDAQ and the rulesRule 13d-5. Each of the SEC applicableReporting Persons disclaims beneficial ownership of the shares of Common Stock referred to herein that such Reporting Person does not hold directly. Waterfall and Messrs. Thomas Capasse and Jack Ross share the power to vote and direct the disposition of the shares owned by the Waterfall Funds. WDGP may be deemed to share the power to vote and direct the disposition of the shares owned by the WDOMF, and WSGP may be deemed to share the power to vote and direct the disposition of the shares owned by WSF. The address for each such committee.of the Waterfall-associated companies is c/o Waterfall Management, LLC, 1140 Avenue of the Americas, 7th Floor, New York, NY 10036.

(4) Morry Rubin’s address is 17853 Key Vista Way, Boca Raton, Florida 33496.

(5) Based solely on the Schedule 13D filed on March 30, 2012 by Morry Rubin, as modified by the Form 4 filed on May 5, 2016, this amount consists of 515,126 shares of Common Stock held by FLEXY 17, LLC, of which Morry Rubin is Manager, and 26,200 shares of Common Stock held in certain family trusts of which Morry Rubin’s spouse and father, George Rubin, are co-trustees.

(6) This amount consists of warrants to purchase 66,667 shares of Common Stock.

(7) Based solely on the Schedule 13G filed on August 24, 2018 by PITA Holdings LLC, this amount consists of shares of Common Stock held by PITA Holdings LLC, of which Howard Dvorkin is manager. This row does not include shares of our Common Stock issuable upon conversion of an outstanding subordinated promissory note issued to NRNS Capital Holdings LLC, of which Mr. Dvorkin is Manager, as described under “Certain Relationships and Related Transactions – Subordinated Promissory Notes.” The address of PITA Holdings LLC is 6360 NW 5th Way, Ft. Lauderdale, Florida 33309.

(8) George Rubin’s address is 120 Central Park South, New York City, New York 10019.

(9) According to the Schedule 13D/A filed on November 30, 2015 by George Rubin, 26,200 shares of Common Stock are held in certain family trusts of which he and Morry Rubin’s spouse are co-trustees.

(10) Based solely on the Schedule 13D/A filed on November 30, 2015 by George Rubin. Consists of warrants to purchase 66,667 shares of Common Stock.

(11) Consists of vested options to purchase 24,000 shares of Common Stock.

(12) These shares of Common Stock are owned directly by Mr. Bernstein’s spouse. Mr. Bernstein disclaims beneficial ownership of these shares of Common Stock.

(13) Consists of vested options to purchase 90,000 shares of Common Stock.

(14) Consists of vested options to purchase 25,000 shares of Common Stock. Does not include shares of our common stock issuable upon conversion of outstanding subordinated promissory notes as described under “Certain Relationships and Related Transactions – Subordinated Promissory Notes.”

(15) Consists of vested options to purchase 24,000 shares of Common Stock.

(16) The employment of Marc Malaga ended on July 27, 2017.

(17) Consists of warrants to purchase 66,667 shares of Common Stock, vested options to purchase 50,000 shares of Common Stock, and Series 1 Preferred Stock convertible into 41,338 shares of Common Stock.

(18) Consists of 6,250 shares held in a trust, of which Mr. Pradelli is trustee and beneficial owner, and 12,500 shares held by a limited liability company owned by Mr. Pradelli and his spouse.

(19) Consists of vested options to purchase 24,000 shares of Common Stock.

(20) Consists of vested options to purchase 10,000 shares of Common Stock.

Board Leadership StructureWHERE YOU CAN OBTAIN ADDITIONAL INFORMAtION

We have a Chairmanfile annual, quarterly and current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You can read our SEC filings, including the Consent Solicitation Statement, at the SEC’s website at www.sec.gov.

You may read and copy this information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549, at prescribed rates. You may obtain information regarding the operation of the Board who presidespublic reference room by calling the SEC at all meetings of the Board. Currently, Mr. Bernstein serves as the Chairman of the Board, President and Chief Executive Officer. FlexShopper has no fixed policy with respect to the separation of the offices of the Chairman of the Board and Chief Executive Officer. Our bylaws permit these positions to be held by the same person, and the Board believes that it is in the best interests of the Company to retain flexibility in determining whether to separate or combine the roles of Chairman and Chief Executive Officer based on our circumstances. The Board has determined that it is appropriate for Mr. Bernstein to serve as both Chairman and Chief Executive Officer because combining the roles of Chairman and Chief Executive Officer: (1) enhances the alignment between the Board and management in strategic planning and execution as well as operational matters, (2) avoids the confusion over roles, responsibilities and authority that can result from separating the positions, and (3) streamlines board process in order to conserve time for the consideration of the important matters the Board needs to address. Further, five of our seven current Board members have been deemed to be independent by our Board; therefore, we believe our Board structure provides sufficient independent oversight of our management. The Board has not named a lead independent director.

Policy Governing Security Holder Communications with the Board of Directors

Security holders who wish to communicate directly with the Board, the independent directors of the Board or any individual member of the Board may do so by sending such communication by certified mail addressed to the Chairman of the Board, the entire Board of Directors, to the independent directors as a group or to the individual director or directors, in each case, c/o Secretary, FlexShopper, Inc., 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431. The Secretary reviews any such security holder communication and forwards relevant communications to the addressee.

Policies Regarding Director Nominations1-800-SEC-0330.

The Board of Directors has adoptedSEC also maintains a policy concerning director nominations reflected in the charter of the Corporate Governancewebsite (http://www.sec.gov) that contains reports, proxy and Nominating Committee, a copy of which is available at http://investors.flexshopper.com/. Set forth below is a summary of certain provisions of this policy.

Director Qualifications

The Corporate Governanceinformation statements and Nominating Committee is responsible for, among other things: (1) recommending to the Board persons to serve as members of the Board and as members of and chairpersons for the committees of the Board, (2) considering the recommendation of candidates to serve as directors submitted from the stockholders of the Company, (3) assisting the Board in evaluating the Board’s and its committee’s performance, (4) advising the Boardinformation regarding the appropriate board leadership structure for the Company, (5) reviewing and making recommendations to the Board on corporate governance and (6) reviewing the size and composition of the Board and recommending to the Board any changes it deems advisable.

The Board seeks independent directors who represent a diversity of backgrounds and experiencesissuers that will enhance the quality of the Board’s deliberations and decisions. Candidates shall have substantial experience with one or more publicly traded companies or have achieved a high level of distinction in their chosen fields. The Board is particularly interested in maintaining a composition that includes individuals who are active or retired executive officers and senior executives, particularly those with experience in the finance and capital markets industries. In evaluating nominations to the Board, our Board also looks for certain personal attributes, such as integrity, ability and willingness to apply sound and independent business judgment, comprehensive understanding of a director’s role in corporate governance, availability for meetings and consultation on Company matters, and the willingness to assume and carry out fiduciary responsibilities. Qualified candidates for membership on the Board will be considered without regard to race, color, religion, sex, ancestry, national origin or disability.

Process for Identifying and Evaluating Director Nominees

The Board is responsible for selecting nominees for election to the Board by the stockholders. The Board delegates the selection process to the Corporate Governance and Nominating Committee, with the expectation that other members of the Board, and of management, may be requested to take part in the process as appropriate. Generally, the Corporate Governance and Nominating Committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisers, through the recommendations submitted by other directors or stockholders or through such other methods as the Corporate Governance and Nominating Committee deems appropriate. Once candidates have been identified, the Corporate Governance and Nominating Committee confirms that the candidates meet the qualifications for director nominees established by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks, or any other means that the Corporate Governance and Nominating Committee deems to be helpful in the evaluation process. The Corporate Governance and Nominating Committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board. Based on the results of the evaluation process, the Corporate Governance and Nominating Committee recommends candidates for the Board’s approval as director nominees for election to the Board.

Procedures for Recommendation of Director Nominees by Stockholders

The policy of the Corporate Governance and Nominating Committee is to consider properly submitted stockholder recommendations for director candidates. To submit a recommendation to the Corporate Governance and Nominating Committee for director nominee candidates, a stockholder must make such recommendation in writing and include:

Recommendations must be sent to the Chairperson of the Corporate Governance and Nominating Committee, c/o Secretary, FlexShopper, Inc., 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431. The Secretary must receive any such recommendation for nomination not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the date of the proxy statement delivered to stockholders in connection with the preceding year’s annual meeting of stockholders; provided, however, that with respect to a special meeting of stockholders called by us for the purpose of electing directors to the Board of Directors, the Secretary must receive any such recommendation not earlier than the 90th day prior to such special meeting nor later than the later of (1) the close of business on the 60th day prior to such special meeting or (2) the close of business on the 10th day following the day on which a public announcement is first made regarding such special meeting. We will promptly forward any such nominations to the Corporate Governance and Nominating Committee. Once the Corporate Governance and Nominating Committee receives a recommendation for a director candidate, such candidate will be evaluated in the same manner as other candidates and a recommendation with respect to such candidate will be delivered to the Board of Directors.

Policy Governing Director Attendance at Annual Meetings of Stockholders

Each director is encouraged to attend the annual meeting of stockholders in person. We did not have a 2016 annual meeting of stockholders.

Code of Ethics for Senior Financial Officers

We have in place a Code of Ethics for Senior Financial Officers, which applies to the Company’s executive officers (collectively, the “Senior Financial Officers”) and is designed to deter wrongdoing and to promote honest and ethical conduct, proper disclosure of financial information and compliance with applicable laws, rules and regulations among the Senior Financial Officers. A current copy of the Code of Ethics is available in our public filings with the SEC. We intend to disclose any amendments to or waivers of a provision of the Code of Ethics by posting such information on our website available at http://investors.flexshopper.com/ and/or in our public filingsfile electronically with the SEC.

THE BOARD OF DIRECTORS AND ITS COMMITTEESOur website can be accessed at www.flexshopper.com. The information contained on, or that may be obtained from, our website is not, and shall not be deemed to be, a part of this Consent Solicitation Statement.

Board of DirectorsINCORPORATION OF CERTAIN INFORMATION BY REFERENCE

Our bylaws stateThe SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this Information Statement. Information in this Information Statement supersedes information incorporated by reference that we filed with the numberSEC prior to the date of directors constituting the entire Board of Directors shall be determined by resolution of the Board and that the Board has the authority to increase the number of directors, fill any vacancies on the Board and to decrease the number of directors; provided, that no decrease in the number of directors shall shorten the term of any incumbent directors. The number of directors currently fixed by our Board is seven.this Information Statement.

Our Board of Directors met four times duringWe incorporate by reference into this Information Statement the information or documents listed below that we have filed with the SEC:

● our annual report on Form 10-K for the fiscal year ended December 31, 2016. No director attended less than 75 percent of all meetings of2017 filed with the Board and applicable committee meetings in 2016 held during the period for which he or she was a director. The Board of Directors currently has standing Audit, Compensation and Corporate Governance and Nominating Committees. The Board and each standing committee retains the authority to engage its own advisors and consultants. Each standing committee has a charter that has been approved by the Board of Directors. A copy of each committee charter is available at http://investors.flexshopper.com/. Each committee reviews the appropriateness of its charter annually or at such other intervals as each committee determines.SEC on March 8, 2018;

The following table sets forth● the current members ofinformation specifically incorporated by reference into our annual report on Form 10-K for the Audit, Compensationfiscal year ended December 31, 2017 from our definitive proxy statement on Schedule 14A filed with the SEC on March 13, 2018 and Corporate Governance and Nominating Committees of the Board:amended on April 19, 2018;

● our quarterly reports on Form 10-Q for the fiscal quarter ended March 30, 2018 filed with the SEC on May 14, 2018 and for the fiscal quarter ended June 30, 2018 filed with the SEC on August 6, 2018;

● our Current Reports on Form 8-K filed with the SEC on January 12, 2018, February 2, 2018, March 7, 2018, April 6, 2018, April 19, 2018, April 30, 2018 and August 31, 2018; and

● the description of our Common Stock contained in our Registration Statement on Form 8-A filed with the SEC on November 14, 2016, including any amendment or report filed for the purpose of updating such description.

8

CommitteesCAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER

Audit Committee. Our Audit Committee consists of Mr. Allen, Mr. KingINFORMATION CONTAINED IN THIS CONSENT SOLICITATION STATEMENT

Certain information set forth in this Consent Solicitation Statement and Mr. Pradelli. The Board of Directors has determined that each member of the Audit Committee is independentdocuments incorporated herein by reference may contain forward-looking statements within the meaning of the NASDAQ director independence standards and applicable rulesSection 27A of the SEC for audit committee members. The BoardSecurities Act of Directors has elected Mr. Allen1933, as Chairperson of the Audit Committeeamended, and has determined that he qualifies as an “audit committee financial expert” under the rules of the SEC. The Audit Committee is responsible for assisting the Board of Directors in fulfilling its oversight responsibilities with respect to financial reports and other financial information. The Audit Committee (1) reviews, monitors and reports to the Board of Directors on the adequacy of the Company’s financial reporting process and system of internal controls over financial reporting, (2) has the ultimate authority to select, evaluate and replace the independent auditor and is the ultimate authority to which the independent auditors are accountable, (3) in consultation with management, periodically reviews the adequacy of the Company’s disclosure controls and procedures and approves any significant changes thereto, (4) provides the audit committee report for inclusion in our proxy statement for our annual meeting of stockholders and (5) recommends, establishes and monitors procedures for the receipt, retention and treatment of complaints relating to accounting, internal accounting controls or auditing matters and the receipt of confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters. The Audit Committee was formed in March 2016 and met three times in 2016.

Compensation Committee. Our Compensation Committee presently consists of Mr. Allen, Mr. King and Mr. Pradelli, each of whom is a non-employee director as defined in Rule 16b-3Section 21E of the Exchange Act. The Board has also determinedAct that each memberare intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “could,” “would,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate” “strategy,” “future,” “likely” or other comparable terms and references to future periods. All statements other than statements of historical facts included in this Consent Solicitation Statement and documents incorporated herein by reference regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding the filing of the Compensation Committee is also an independent director withinCertificate of Amendment and the meaning of NASDAQ’s director independence standards. Mr. King serves as Chairpersonpotential uses of the Compensation Committee. The Compensation Committee (1) dischargesincreased number of authorized shares of Common Stock resulting from such action.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the responsibilitiesfuture of our business, future plans and strategies, projections, anticipated events and trends, the Board of Directors relatingeconomy and other future conditions. Because forward-looking statements relate to the compensationfuture, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our directorscontrol. Our actual results and executive officers, (2) overseesfinancial condition may differ materially from those indicated in the Company’s procedures for considerationforward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and determinationfinancial condition to differ materially from those indicated in the forward-looking statements include those described in the Risk Factors and in Management’s Discussion and Analysis of executiveFinancial Condition and director compensation, and reviews and approves all executive compensation, and (3) administers and implements the Company’s incentive compensation plans and equity-based plans. The Compensation Committee was formedResults of Operations sections in March 2016 and did not meet in 2016.

Corporate Governance and Nominating Committee. Our Corporate Governance and Nominating Committee consists of Mr. Allen, Mr. King and Mr. Pradelli. The Board of Directors has determined that each member of the Corporate Governance and Nominating Committee is an independent director within the meaning of the NASDAQ director independence standards and applicable rules of the SEC. Mr. Pradelli serves as Chairperson of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee (1) recommends to the Board of Directors persons to serve as members of the Board of Directors and as members of and chairpersons for the committees of the Board of Directors, (2) considers the recommendation of candidates to serve as directors submitted from the stockholders of the Company, (3) assists the Board of Directors in evaluating the performance of the Board of Directors and the Board committees, (4) advises the Board of Directors regarding the appropriate board leadership structure for the Company, (5) reviews and makes recommendations to the Board of Directors on corporate governance and (6) reviews the size and composition of the Board of Directors and recommends to the Board of Directors any changes it deems advisable. The Corporate Governance and Nominating Committee was formed in March 2016 and did not meet in 2016.

Role of the Board of Directors in Risk Oversight

Enterprise risks are identified and prioritized by management and the Board receives periodic reports from the Company’s head of compliance regarding the most significant risks facing the Company. These risks include, without limitation, the following:

The Audit Committee is comprised of James Allen, T. Scott King and Carl Pradelli. None of the current or former members of the Audit Committee is an officer or employee of the Company, and the Board has determined that each member of the Audit Committee meets the independence requirements promulgated by The NASDAQ Stock Market and the SEC, including Rule 10A-3(b)(1) under the Exchange Act.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls and the certification of the integrity and reliability of the Company’s internal controls procedures. In fulfilling its oversight responsibilities, the Audit Committee has reviewed the Company’s audited financial statements included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2016,2017.

Any forward-looking statement made by us in this Consent Solicitation Statement or any document incorporated herein by reference is based only on information currently available to us and has discussed them with both managementspeaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as may be required under applicable law. We anticipate that subsequent events and EisnerAmper LLP (“EisnerAmper”), the Company’s independent registered public accounting firm. The Audit Committee has also discusseddevelopments will cause our views to change. You should read this Consent Solicitation Statement completely and with the independent registered public accounting firmunderstanding that our actual future results may be materially different from what we expect. Our forward-looking statements do not reflect the matters required to be discussedpotential impact of any future acquisitions, merger, dispositions, joint ventures or investments we may undertake. We qualify all of our forward-looking statements by the Auditing Standard No. 1301,Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board. The Audit Committee has reviewed permitted services under rules of the SEC as currently in effect and discussed with EisnerAmper their independence from management and the Company, including the matters in the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee has also considered and discussed the compatibility of non-audit services provided by EisnerAmper with that firm’s independence.these cautionary statements.

FUTURE PROPOSALS OF STOCKHOLDERS

Based on its reviewRequirements for Stockholder Proposals to Be Considered for Inclusion in the Company’s Proxy Materials. Stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 2019 annual meeting of stockholders must be received by November 13, 2018. In addition, all proposals will need to comply with Rule 14a-8 of the financial statements andExchange Act, which lists the aforementioned discussions,requirements for the Audit Committee concluded that it wouldinclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals must be reasonable to recommend, and on that basis did recommend,delivered to the BoardCompany’s Secretary at 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431.

Requirements for Stockholder Proposals to Be Brought Before the 2019 Annual Meeting of DirectorsStockholders. Notice of any director nomination or other proposal that you intend to present at the audited financial statements be2019 annual meeting of stockholders, but do not intend to have included in the proxy statement and form of proxy relating to the 2019 annual meeting of stockholders, must be delivered to the Company’s Annual Report.Secretary at 2700 North Military Trail, Ste. 200, Boca Raton, Florida 33431 not earlier than the close of business on December 27, 2018 and not later than the close of business on January 26, 2019. In addition, your notice must set forth the information required by our bylaws with respect to each director nomination or other proposal that you intend to present at the 2019 annual meeting of stockholders.

ANNEX A

Respectfully submitted by the Audit Committee.CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF INCORPORATION

OF

FLEXSHOPPER, INC.

FLEXSHOPPER, INC., a corporation duly organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify that:

1. The Certificate of Incorporation of the Corporation is hereby amended by deleting Section 1 of Article FOURTH thereof in its entirety and replacing Section 1 of Article FOURTH with the following:

“Section 1.Authorization of Shares.

The aggregate number of shares of capital stock which the Corporation will have authority to issue is 25,500,000 shares, consisting of 25,000,000 shares of common stock, having a par value of $.0001 per share (“Common Stock”), and 500,000 shares of Preferred Stock, having a par value of $.001 per share (“Preferred Stock”).”

2. The foregoing amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, FLEXSHOPPER, INC. has caused this Certificate to be executed by its duly authorized officer on this ___ day of ________________, 2018.

| By: | ||

| Brad Bernstein | ||

| Title: |

COMPENSATION AND OTHER INFORMATION CONCERNING DIRECTORS AND OFFICERS

Our compensation philosophy is to offer our executive officers compensation and benefits that are competitive and meet our goals of attracting, retaining and motivating highly skilled management, which is necessary to achieve our financial and strategic objectives and create long-term value for our stockholders. We believe the levels of compensation we provide should be competitive, reasonable and appropriate for our business needs and circumstances. The principal elements of our executive compensation program have to date included base salary and long-term equity compensation in the form of stock options.

The following table sets forth information concerning the compensation earned by the individual that served as our PrincipalPresident and Chief Executive Officer during 2016 and our two most highly compensated executive officers other than the individual who served as our Principal Executive Officer during 2016 (collectively, the “named executive officers”):

Summary Compensation Table